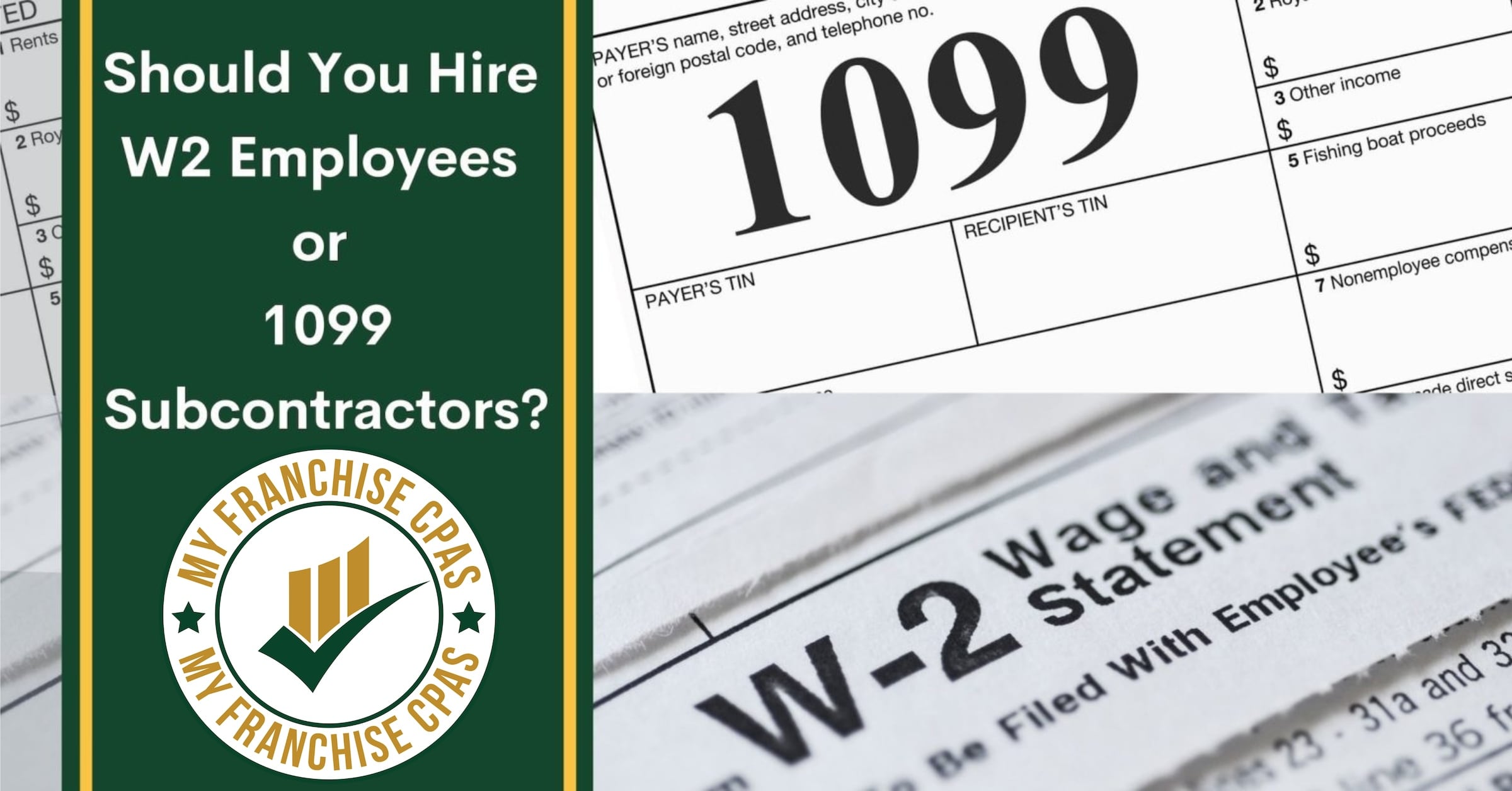

Should You Hire W2 Employees, or 1099 Subcontractors?

Should You Hire W2 Employees or 1099 Subcontractors? When running a business, every entrepreneur must decide whether to hire employees. Once your business grows to the point where hired help is necessary, the choice becomes whether to hire W2 employees or 1099 independent contractors. This decision is important because these types of employees operate very […]