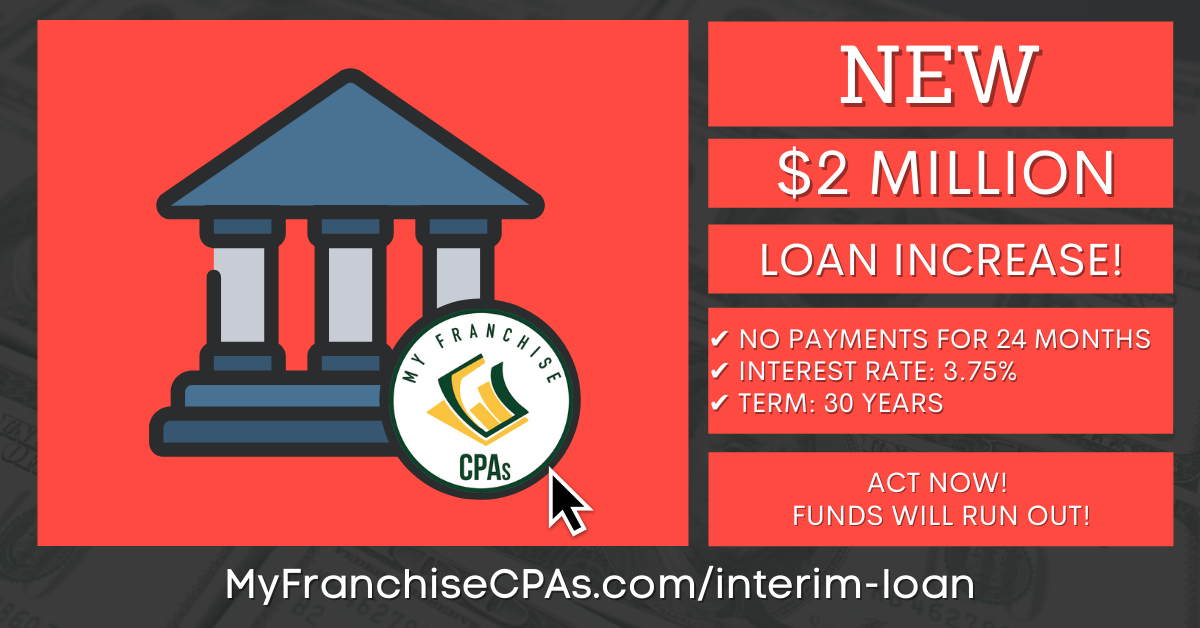

Government Stimulus Available for Small Businesses

Government stimulus available for small businesses Plan for your small business; the government can and will help! Small businesses take time, energy, and money to become a success. From opening your small business to maintaining everyday operations, small business funding is vital. You must have a consistent cash flow to cover the company, employees, tools, […]