How to Deal: COVID-19 (Coronavirus) and How to Brace For Impact – Franchise and Small Business Owners

In the midst of the Coronavirus outbreak, people and small businesses alike are in panic mode. Toilet paper is nowhere in sight. Water has run dry. While things may seem bleak, there is a silver lining for diligent small business and franchise owners who are determined to survive the downturn.

We have compiled this emergency list of resources that will help you, both on a personal and business level.

We will update this blog live as new developments arise.

**LIVE UPDATES**

- Remember that March 16, 2020 is the LAST day to extend any business return you have (1065, 1120, 1120S, etc.).

- Tax Day has been moved from April 15th to July 15th

- U.S. Small Business Administration Administrator Jovita Carranza Implements Automatic Deferment on Existing SBA Disaster Loans Through End of 2020

- On Friday, March 27, President Donald Trump signed into law a $2.2 Trillion (with a T) stimulus bill to benefit individuals and business owners like. Most small business owners can take advantage of up to $10M in forgivable loans. Also, the old disaster relief loans now include a $10,000 advance grant portion, where you can get $10,000 deposited into your account in just 3 days. The bill also includes $1,200 per taxpayer adult and $500 per child 17 years or younger. The benefit beginning phasing out at $75,000 in 2018 income. At $99,000, the benefit is reduced to zero.

- As of March 30 at 12:35p EST, America remains the country with the most COVID-19 cases at >144K confirmed cases. President Trump mentioned potentially “re-opening” the country by April 30, although there is no exact date set.

- 6/3 Paycheck Protection Program Flexibility Act of 2020Senate passed House legislation to loosen restrictions on PPP small business loans.

– Gives businesses 24 weeks to use the funds

– 60 percent of the covered loan amount for payroll costs

– Rehiring provisions

– Repayment extends to 5 years from 2 years if the loan does not convert into a grant

Who Has Been Impacted? How Far Has the Virus Spread?

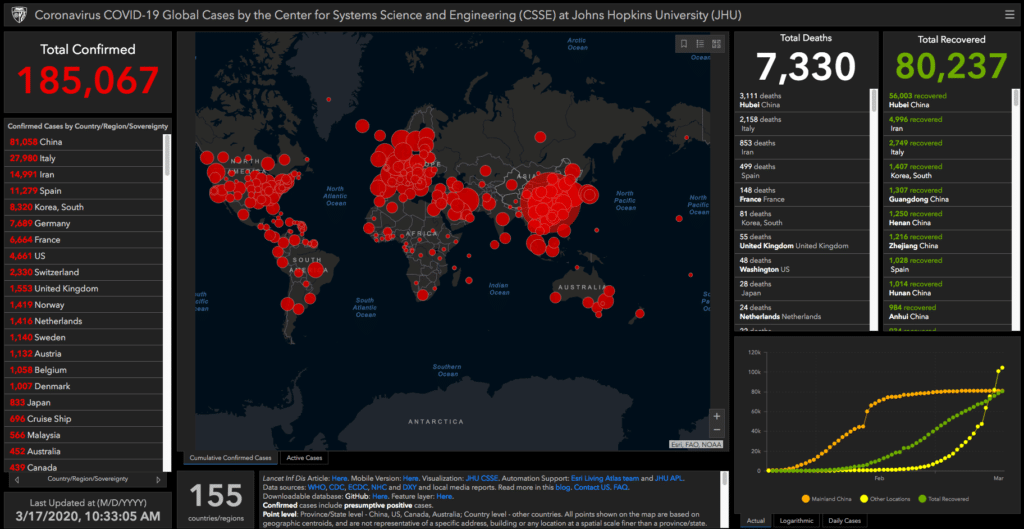

We find the John Hopkins live map to be the easiest to navigate and tell how far the virus has spread.

You can find the map here: https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

(Screenshot from 3/17/2020 10:33 AM EST)

I own a business. What help is available to me?

Financial Support

The government has signaled billions of dollars in loans (potentially interest free) for businesses that have been negatively affected by coronavirus. We will be providing consulting services helping businesses apply for these loans, decide what to spend the money one, and a plan for repayment. There may also be direct cash support, we’ll know soon.

Reduction in payroll tax for someone that is sick up to $2,000 per sick employee is about to pass the Senate. There may be further payroll tax reductions, holidays, and there have even been signals per permanently removing the payroll tax. In any case, this will require planning.

As of now, President Trump has announced there will be tax deadline delays available to those adversely affected by the virus.

Federal Support

The Small Business Administration (SBA) will be offering financial support to small businesses adversely impacted by the virus (which likely includes everyone reading this post). The SBA will be announcing which territories and states will be able to take advantage of these Economic Injury Disaster Loan assistance programs. We will update this blog with live information as it is received. These loans will be up to $2 million and can be used to pay for bills which otherwise could not be paid due to the downturn (fixed assets, debt, payroll, etc.)

See our blog on SBA Loans for more on funding a franchise with SBA loans.

As of March 17, 2020, the following states are eligible for disaster assistance loans:

-

-

- California

- Washington State

- Idaho

- Oregon

- Maine

- New Hampshire

- Connecticut

- Massachusetts

- New York

- Rhode Island

-

State and Local

Some state and local governments are offering custom support for small businesses.

If you’re curious about your state, or live in one of the states eligible for disaster assistance listed above, click HERE to schedule a time to talk about unique relief available to you.

Business Survival Strategies

Offer Discounts

Look, in a time of economic downturn, you need to remain competitive. As your competition is fighting to retain and gain new clients, they will offer discounts. You need to do the same.

Do an Expense Audit

What expenses can you cut? Eliminate? Cost control is key in surviving an economic downturn. We are offering low-cost expense audits to our clients where we quickly help you determine how to reduce your costs in the coming months. To take advantage of a low-cost expense audit, click HERE to speak with one of our experts today.

Make that Meeting a Zoom Meeting!

My Franchise CPAs loves Zoom!

While we serve our local community from Boca Raton, Florida, we also serve the entire USA, and we do it through Zoom meetings!

Zoom meetings look and sound great, and they make screen-sharing simple.

While we can’t make it to everyone’s office in person, we can make it there with Zoom… and no one has to fight traffic, shake hands, bump elbows, or worry about social distancing!

Subscribe to our Emergency COVID-19 Newsletter

In response to the virus, we have established a special newsletter available only to direct subscribers.

This will be a weekly newsletter where we provide advice and news regarding the virus as it impacts American businesses.

🔗 To subscribe, click here.

P.S.: The Lighter Side – Living and Working at Home

Morning Brew presents current events in a concise, comical way.

We love getting our news from Morning Brew, and for Covid-19 Managing Editor Neal Freyman wrote a great article on how to live and work at home for the coming months.

Check out Morning Brew’s Guide to Living Your Best Quarantined Life